The Costs of Inflation

The Construction of Price Indexes

The Advantages and Disadvantages of Using the Different Tools of Fiscal Policy

Factors Influencing the Mix of Fiscal and Monetary Policy

Calculation of GDP – Income Approach

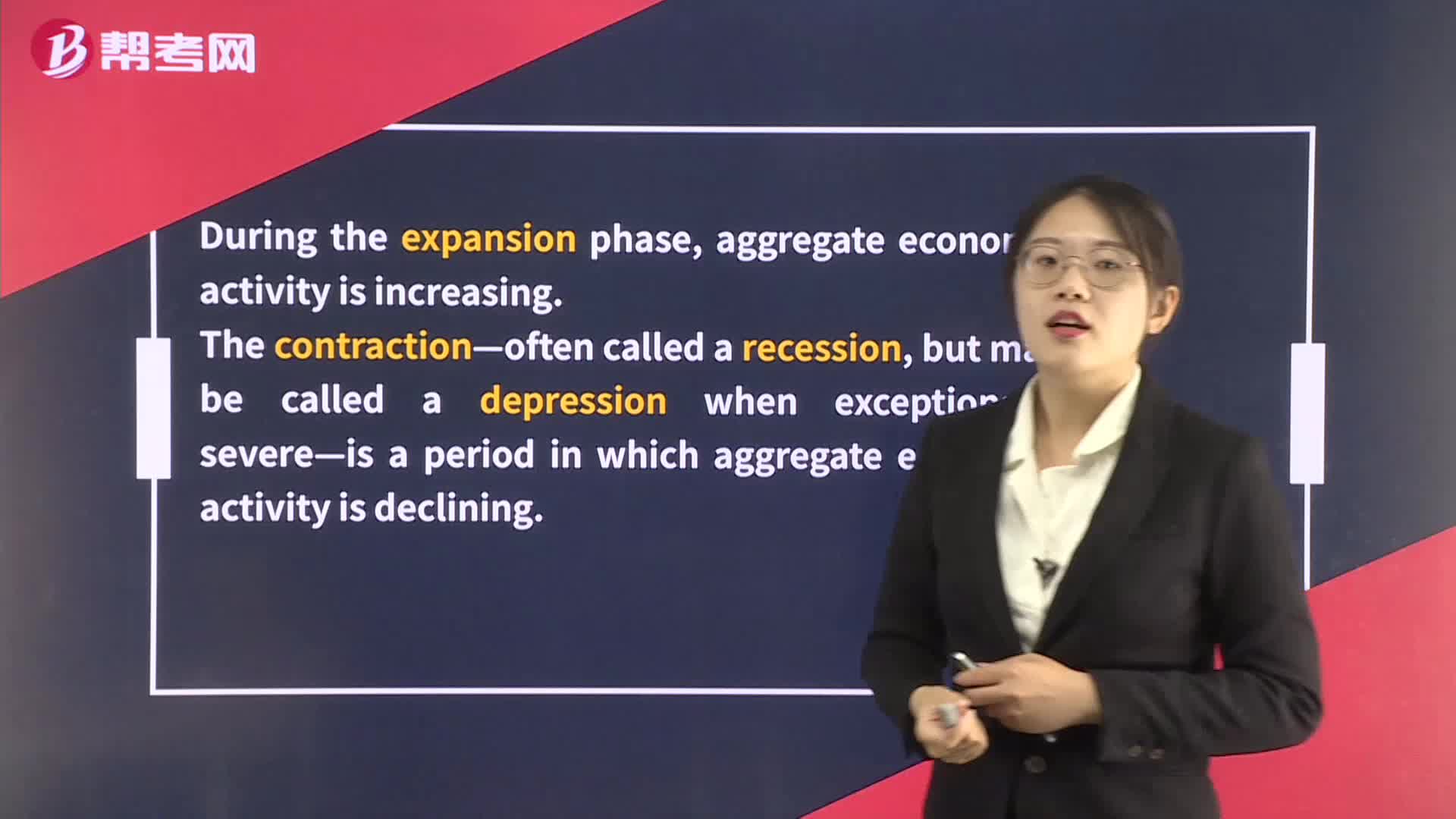

Limitations of Monetary Policy

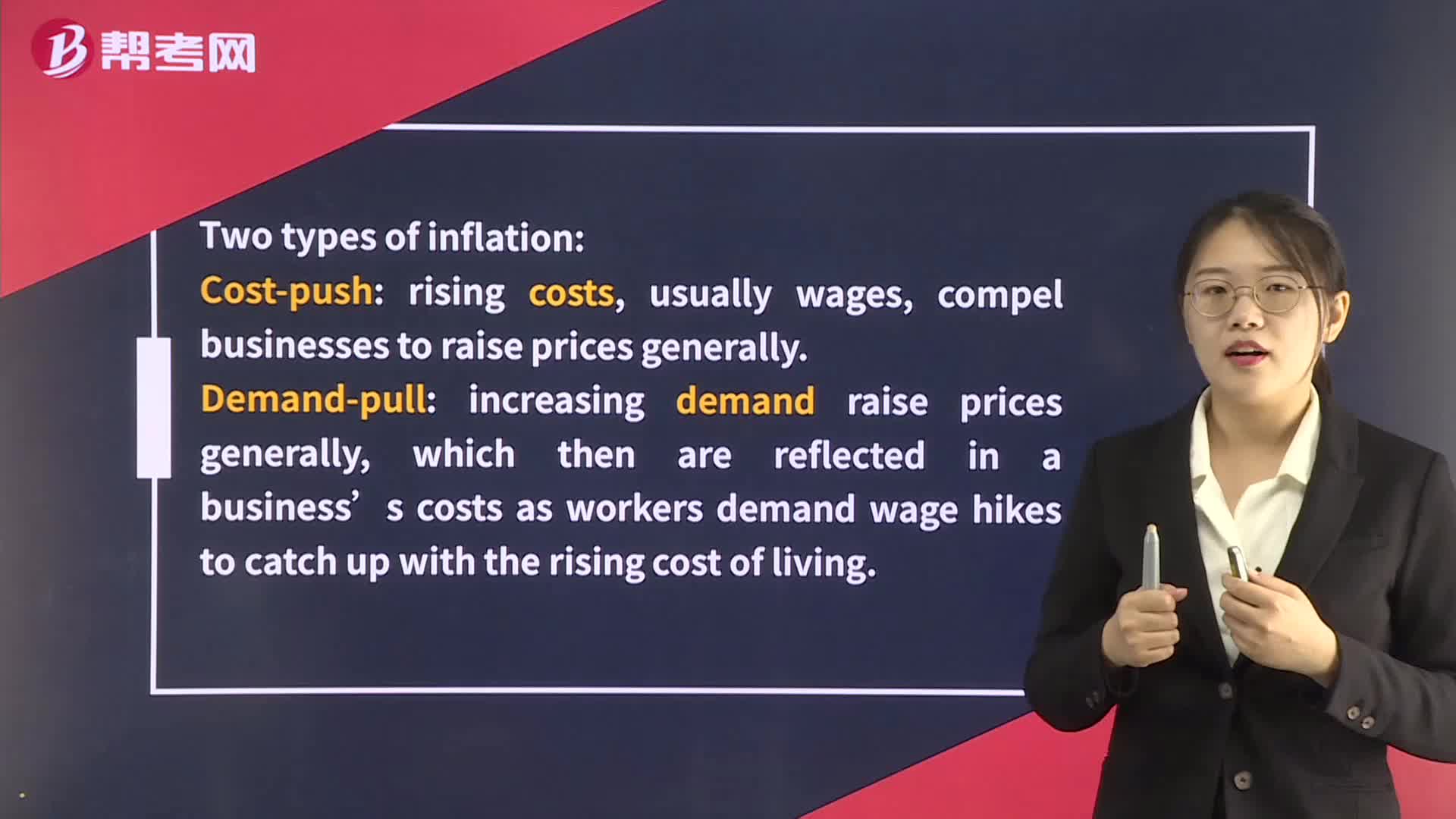

Theories of the Business Cycle - Neoclassical and Austrian Schools

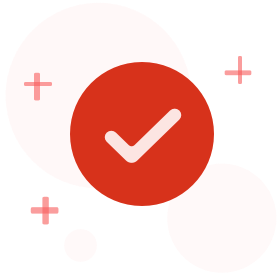

Inflation

Inflation Targeting

Theories of the Business Cycle - Monetarist School

Theories of the Business Cycle - Keynesian School

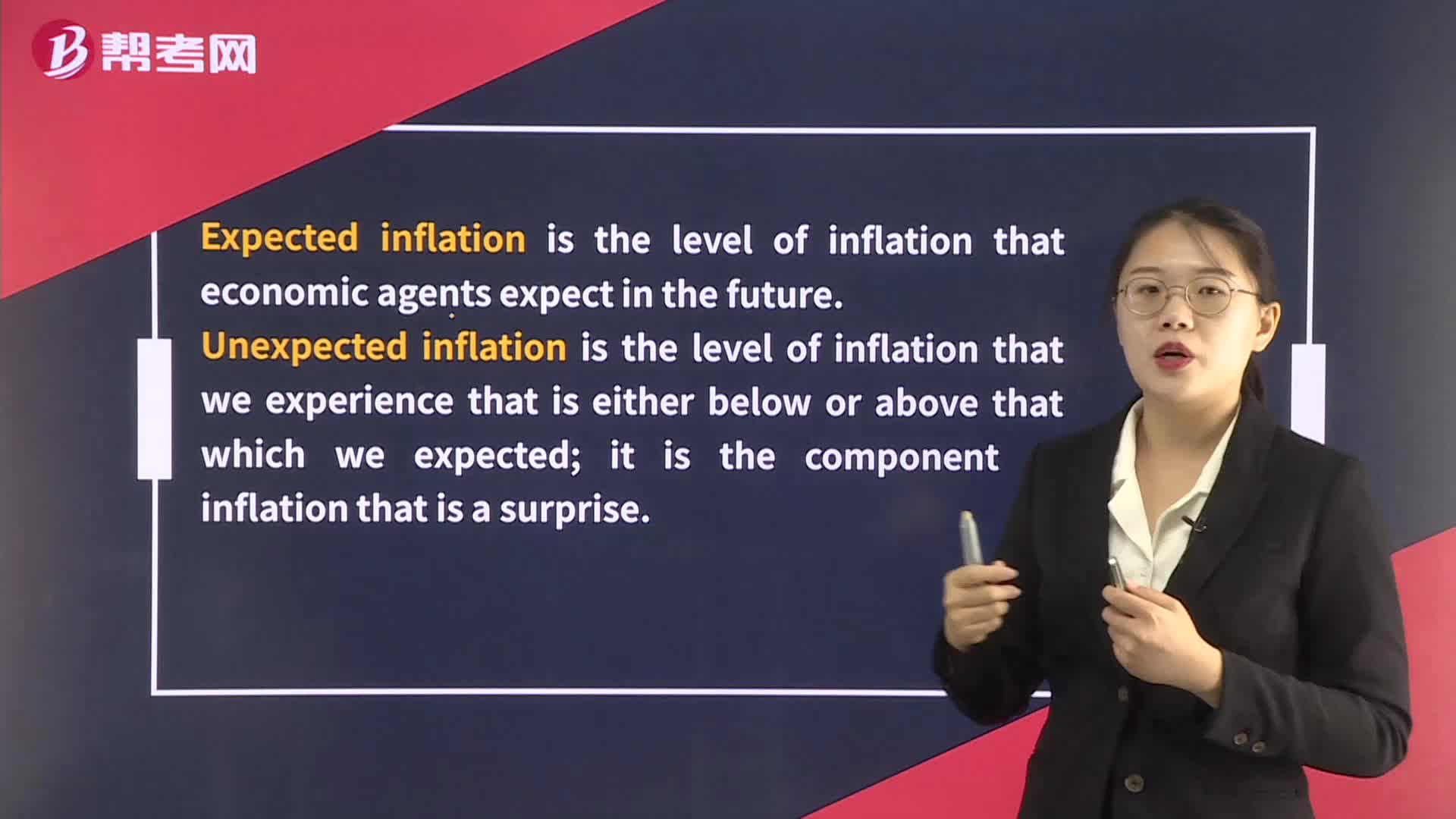

Inflation Expectations

下載億題庫APP

聯系電話:400-660-1360